Background

I first bought RHT's shares in 2017 when there were news that their Sponsor was going to do a buyout of RHT's shares. My intial purchase was done on 28th Feb for 3000 shares at $0.85. I was doing a queue and I managed to get 3000 shares before the Market closed. I subsequently sold off my 3000 shares on 11th Aug at $0.87 after getting a round of dividend in May 2017. I will exclude this purchase when I calculate if I profit or lose from the buyout deal.

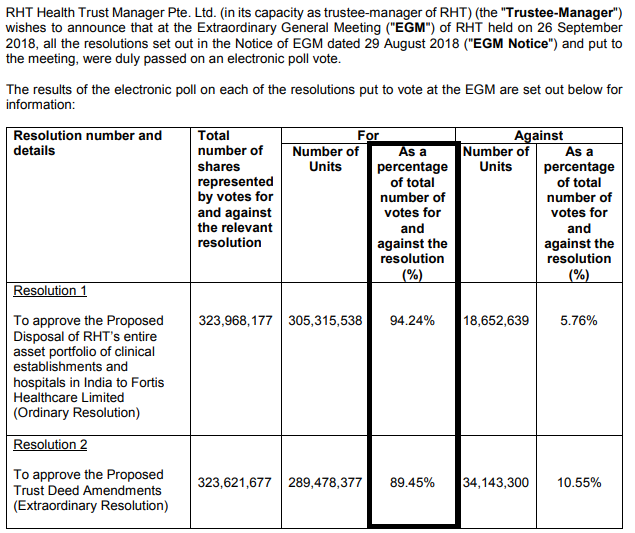

Majority of Shareholders seem to be satisfied with the deal. 94.24% voted Yes! Wow!

Next, I will calculate if I made or lose money with the deal. Hopefully, the result will not send me to hospital.

The Result

On 20th Nov 2017, I made a purchase of 10000 RHT's shares at $0.845. This time round, my intention was to hold until the deal ended. Another purchase of 12000 shares was done on 14th Feb 2018 at a price of $0.815. A final purchase of 10000 shares was done on 16th April at a price of $0.79.

I have tabulated the total dividends that I have received so far from RHT which worked out to $1321.20. The Total Cost below included commissions that I paid when I bought the shares. I am aware that there is a so-called 5% retention of the net proceeds. I do not know what will happen to this amount of money. Pay year-end bonus to the Management for a well done job? Huge support from shareholders ought to justify a fat bonus. Or return remaining amount back to shareholders eventually? To be honest, I rather they just delist the company and return remaining proceeds back to shareholders sooner than later. Who's going to pay for RHT's daily operations and staff salary when there's no more rental income? Where's the money going to come from? I am rather disappointed with the deal. Hopefully, I can still squeeze some final dividend from RHT before the deal is finally concluded and $0.766 is returned to shareholders.

Call me an ambulance please!

Dividend History of RHT. Screencap from Dividends.sg

I wouldn't expect to get back much more after the $0.766 payment. I would be happier or should I say less angry if another $0.03 is returned to me for the lousy deal. NAV was $0.786. In my opinion, it's like buying the assets with a slight premium above the NAV (which was around a year of dividends). Technically, those of us who bought RHT's shares this year and in the $0.8x range are getting a bad deal. I wander what did the Management team said during the EGM to convince shareholders to take the bitter pill. 苦口良药?

Lesson learnt: If buying a company's share that's trading above the NAV, there's a chance of getting screwed if a buyout or delist occurs. The share price may have fallen during that time and the offer price could only be a slight premium above NAV or worse still current price. Of course, there are good REITs like Capital Mall Trust and Parkway Life which is often trading above the NAV. I would not mind buying them above the NAV price. One important criteria when we want to build a huge position in any company is the Management's interests need to be aligned with the shareholders. Are they getting the best deal for investors such as yield-accretive acquisitions? Or are they buying properties just to earn fees? Unfortunately, I have already liquidated my positions in CMT as I find the yield no longer attractive.

P.S - Watch out for my next blog post where I talk about how to get free money for those living in Singapore. If not free money I chop!

P.S - Watch out for my next blog post where I talk about how to get free money for those living in Singapore. If not free money I chop!

Dividend History of RHT. Screencap from Dividends.sg

Give Me More Dividend Pls.

...

No comments:

Post a Comment